La evaluación del rendimiento energético fotovoltaico (EYA) de LuciSun traduce de forma transparente y técnicamente sólida el recurso solar específico del emplazamiento y el diseño del sistema en estimaciones realistas de producción de electricidad.

Su objetivo es apoyar la evaluación de la economía, el riesgo financiero y la viabilidad a largo plazo de los proyectos garantizando que las hipótesis de modelización, las estimaciones de pérdidas y las incertidumbres sean explícitas, trazables e internamente coherentes.

La evaluación ofrece una previsión de producción clara y financiable, con indicadores probabilísticos, que proporciona una base fiable para la inversión, la financiación y la toma de decisiones.

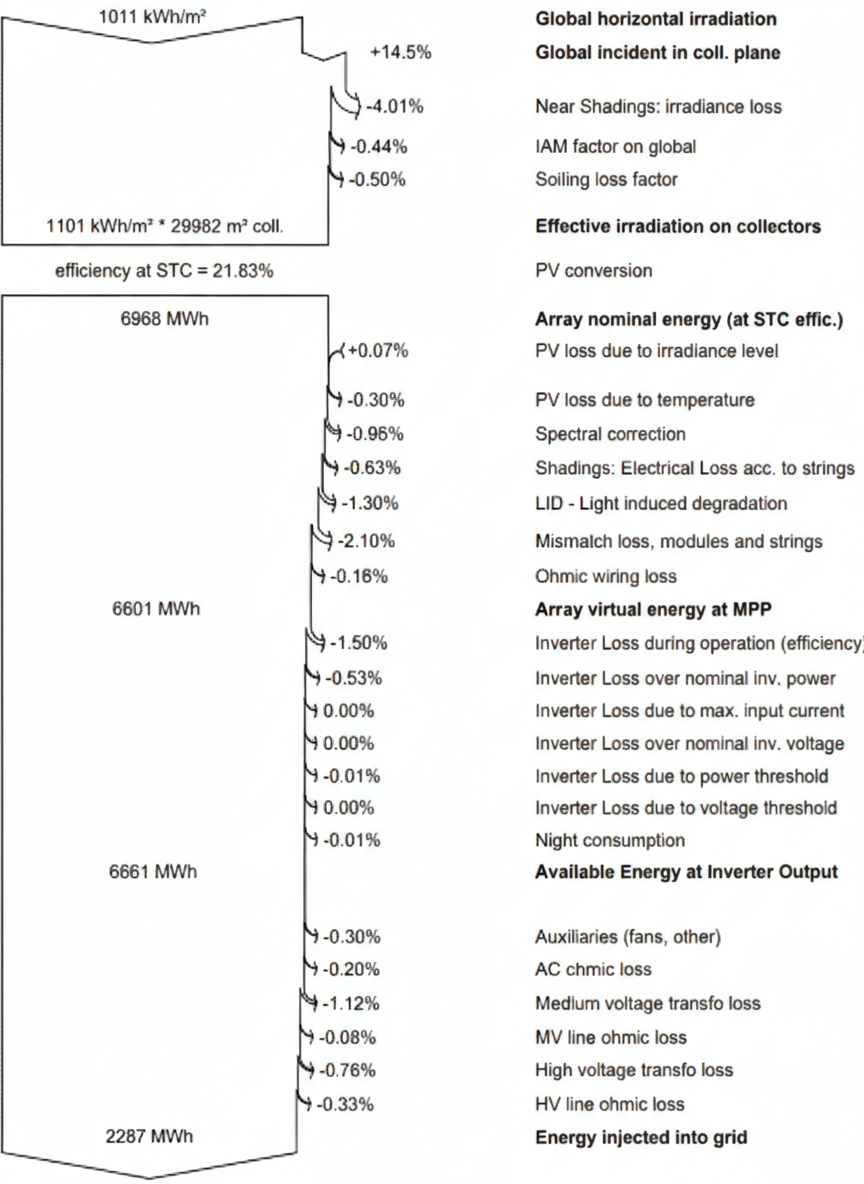

The PV Energy Yield assessment is based on detailed PV system modelling using site specific inputs derived from the Solar Resource Assessment and the project design documentation. Particular attention is given to the relevance and internal consistency of all modelling parameters, including system layout, component characteristics, losses, availability assumptions, and operating conditions. Input values are not treated as generic defaults but are selected and justified based on field experience, operational feedback, and technical literature.

LuciSun adopts a tool agnostic approach to Energy Yield Assessment. Industry standard software such as PVsyst is commonly used as a reference for conventional photovoltaic projects where its modelling framework adequately captures the relevant physical phenomena. Depending on the project context, other tools may be used when they provide a more appropriate representation of system behaviour, including commercial software such as SAM, open source libraries such as pvlib, and in house developed tools such as LuSim. Tools such as LuSim are particularly relevant for complex 3D configurations, bifacial systems, agrivoltaics, building integrated photovoltaics (BIPV), or projects affected by complex shading environments.

When appropriate, multiple tools can be combined within the same assessment. A typical approach consists in establishing a baseline simulation with PVsyst as a widely recognised market reference, complemented by targeted simulations with other tools to refine specific energy gains or losses that are not fully captured by simplified models. This preserves comparability with market standards while improving physical accuracy where it has a material impact on the results.

LuciSun has developed complementary methods and tools that facilitate interoperability between different modelling environments. This includes workflows that allow the conversion and transfer of layouts and geometries from tools such as AutoCAD, SketchUp or PVcase into PVsyst and other simulation platforms. These conversion and interfacing services can be integrated into a full Energy Yield Assessment or provided on a stand alone basis, depending on project needs.

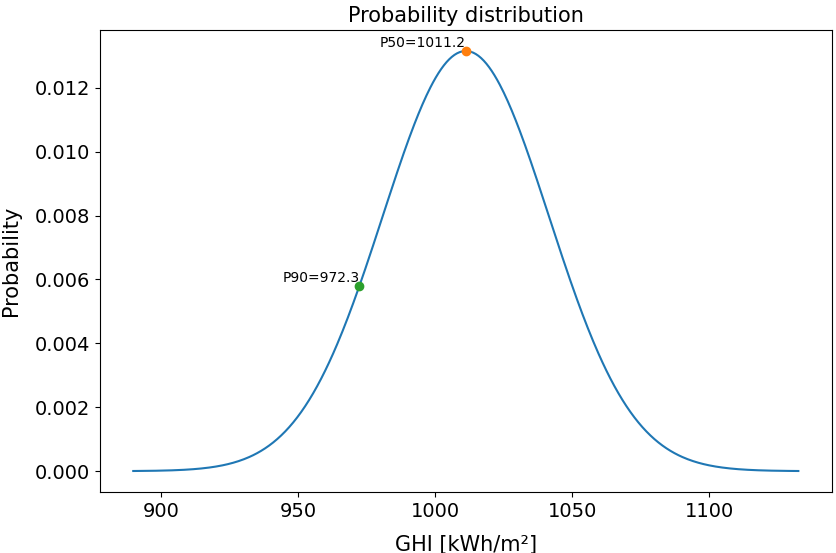

Beyond nominal production values, EYA explicitly addresses project risk through the calculation of exceedance probabilities. Uncertainties related to the solar resource, modelling assumptions, and system performance are quantified and combined using a dedicated internal methodology to derive probabilistic production levels such as P90. These exceedance levels provide conservative and risk adjusted energy estimates that are central to financial structuring and investment decisions.

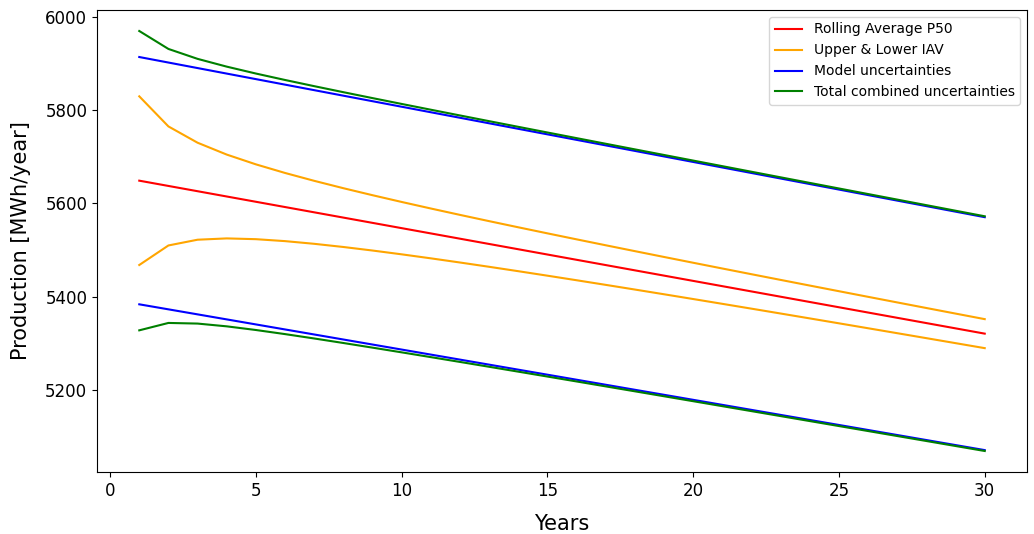

When long-term projections are required, the Energy Yield Assessment is extended to cover the expected lifetime of the asset. This includes the integration of technology specific degradation assumptions, inter-annual variability, and other time dependent effects, providing a coherent view of energy production evolution over periods typically ranging from 10 to 30 years.

The outcome of the PV Energy Yield Assessment is a transparent and bankable production forecast, accompanied by a clear breakdown of assumptions, losses, and uncertainties. This forecast serves as a reference for financial modelling and decision making, while remaining distinct from operational performance analysis carried out on measured data.